The Government Will Always Own Your Home

If you own a home or you're thinking about buying one, I have some bad news.

Jackpot

One person just won the $1 billion Mega Millions jackpot. And 44 people learned they hold a winning Powerball ticket. Every one of them is walking away with at least $1 million.

Bankruptcy Beats a Bailout

The airlines were running on one month's worth of cash when COVID-19 hit.

Who’s Going to Bail You Out?

Three million pets are euthanized every year for economic reasons.

Here’s Why We Won’t Cancel Student Loan Debt

Elizabeth Warren wants to cancel student loan debt.

She recently tweeted that President-elect Joe Biden should issue an executive order that cancels up to $50,000 in student loan debt—unilaterally for everybody.

Biden said Congress can pass a bill that benefits borrowers, which is absolutely within his legal authority. But just because you can, doesn't mean you should.

Passing the Bucks

If you borrow money to go to college, who do you borrow the money from? You don't borrow it from a bank. Banks are out of the business.

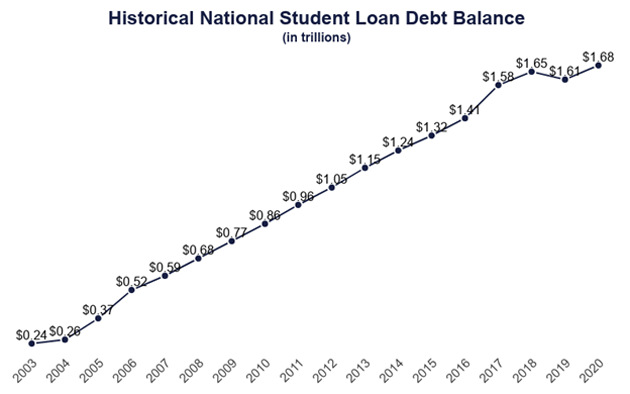

The government took over the student lending business in 2009. It’s made $1.6 trillion in student loans. And all these people have gone to college.

Source: Education Data

Source: Education Data

In that time, student lending has more than doubled. So you don't owe money to the bank; you owe money to the government. Which is worse.

You can say, "Screw you, I'm not paying you," to the bank. And the bank has to eat it.

You can't do that to the government. It doesn't let you off the hook.

Don't Wait Around for Student Loan Debt Relief

People call in to my nightly radio show all the time and ask how to pay off debt. I always say one of the first things you should pay off is student loans.

That's because they are dangerous. If you don't pay them off, they can follow you around forever.

It's really bad. People sign up for these things when they are 18 years old. They borrow $100,000 and have no concept of how big of a number that is.

Then the government charges 8% interest. It does this because it's not a for-profit enterprise.

If the government is really like a nonprofit, then why does it need to charge 8% interest?

The answer: It's unsecured lending.

Low-Interest vs. High-Interest Debt

Secured lending has lower interest rates. Your car has lower interest rates because they can repo the car; your mortgage rate is lower because they can foreclose on you.

With student loans, there is nothing to foreclose on. It's unsecured. And unsecured lending has higher interest rates.

Arguably, given the credit risks of these borrowers, the interest should be even higher… around credit card interest rate levels.

The interest rate is not even the unfair part of the loan. The unfair part is you cannot discharge the loan in bankruptcy.

You go bankrupt, you still have the student loans, and they follow you around forever.

It Gets Worse

You're 18 years old, you sign this piece of paper, and you have $100,000 or even $200,000 following you around for the rest of your life.

Also, if you don’t pay the full interest on a regular basis, it gets added to the principal.

They used to have loans like this in the housing market back in the mid-2000s. They were called negative amortization—NegAM—loans. They got rid of them because it just violates principles of fairness that you would take interest and add it to the principal and the principal gets bigger over time.

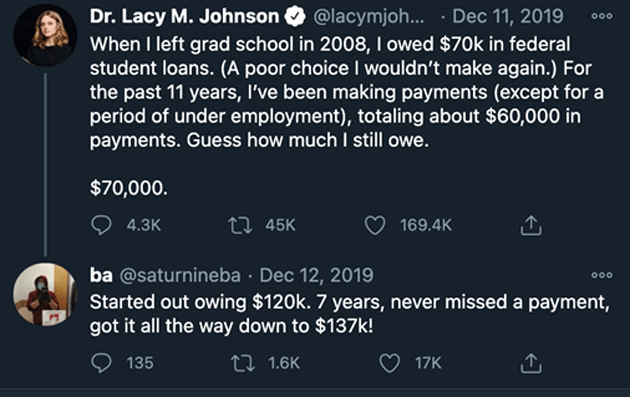

You've probably seen social media posts from people who have made payments for 10 years and their balances got bigger.

Source: Twitter

Source: Twitter

That's because they're not making the full interest payment and it gets added to the principal. It's very evil stuff.

These are the most evil loans of all time, and this is why you should pay these things off first.

The Consequences of Canceling Student Loan Debt

The financial consequence is it all goes on the federal government's balance sheet. It just gets added to the government’s debt.

So if we have $27 trillion in debt right now, it turns into $28.6 trillion.

You might say, well, that isn't so bad, right? We've spent $27 trillion on other stuff. Why not spend $1.6 trillion on student loans?

Here's why…

It gets added to the debt. So we're either going to have to issue $1.6 trillion in bonds. Or we'll have to raise $1.6 trillion in taxes. Or a little bit of both.

Don't Expect the Rich to Pay

Everybody says well, rich people can pay for it. But the math doesn't work.

If you took the top 1% of taxpayers and you raised taxes on them to 100%, do you know how much revenue you would raise? You would raise $800 billion.

So you could tax rich people at 100%—take all their money—and you only get half the amount you need just for the student loans.

If you cancel student loans, everyone's taxes have to go up. Not just rich people’s.

The middle class is where the money is, and it's where the money would have to be raised.

Here's the Real Problem When You Cancel a Debt

It's a liability for someone. Someone has to pay. It's an asset for someone else.

It's an asset for the government. And the government is basically all of us.

The government is taxpayers. So we are shifting the cost of college onto people who aren't going to college.

Biden is wisely sidestepping the issue. That's because a lot of people feel strongly about this.

Like the people who worked their asses off to pay their student loans.

Jared Dillian

|

‹ First < 31 32 33 34 35 > Last ›